Board of Directors

Mr. Conacher was appointed a director in June 2018 and was appointed Chairman of the Board in August 2020. Since November 2021, Mr. Conacher has served as a member of the board of directors and as a member of the audit committee for Better Choice Company, a publicly-traded company. Mr. Conacher was co-founder and managing partner of Next Ventures, GP from July 2018 until February 2021. From January 2011 to June 2018, Mr. Conacher was a senior advisor and operating partner for Altamont Capital Partners LLC (“ACP”), a private equity firm. Additionally, Mr. Conacher served as chairman of Wunderlich Securities, and as a director for Mervin Manufacturing and Dakine, Inc., investee companies of ACP, from December 2013 until July 2018. Prior to joining ACP, from January 2008 until July 2010, Mr. Conacher was the president and chief operating officer of Thomas Weisel Partners, an investment bank. He previously served as a member of the board of directors for Powerdot Inc., AmpHP Inc., SteadyMD Inc., and Kinetyx Sciences Inc.

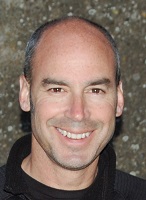

Harvey Kanter is the President, Chief Executive Officer and a director of the Company. Harvey joined the Company on February 19, 2019, in a transition role as Advisor to the Acting CEO and assumed the role of President and Chief Executive Officer and a director of the Company on April 1, 2019. Harvey has over 30 years of business experience, with an extensive background in the retail industry having served from March 2012 until June 2017 as the president and chief executive officer of Blue Nile, Inc., a leading online retailer of high-quality diamonds and fine jewelry. From March 2012 until February 2020, Harvey served as a member of the board of directors of Blue Nile, Inc. and, from January 2014 until February 2020, he served as its chairman. From January 2009 to March 2012, Harvey was the chief executive officer and president of Moosejaw Mountaineering and Backcountry Travel, Inc., a leading multi-channel retailer of premium outdoor apparel and gear. From April 2003 to June 2008, Harvey served in various executive positions at Michaels Stores, Inc. Harvey currently serves as a non-executive co-chair, Seattle University Center for Leadership Formation, Albers School of Business and Economics. Harvey served as a director and a member of the compensation committee of Potbelly Corporation, a publicly traded company from August 2015 until May 2019. He was a former brand ambassador for the Fred Hutch Cancer Research Institute and previously served as an advisory board member to the Seattle University Executive MBA Program. Harvey received his M.B.A. in Marketing from Babson College and his undergraduate degree with a B.S. in Marketing from Arizona State University.

Mr. Boyle has been a director since August 3, 2017. Since February 2019, Mr. Boyle has been the global co-president of direct-to-consumer/omni-channel for Fanatics, Inc. a market leader for officially licensed sports merchandise. Mr. Boyle originally joined Fanatics as president of merchandising in June 2012, and from December 2017 to February 2019, served as co-president of North America direct-to-consumer/omni channel. Prior to that, from February 2005 to June 2012, Mr. Boyle was the executive vice president, general merchandise manager of women’s apparel, intimate, cosmetics and accessories for Kohl’s Corporation. From October 2003 to February 2005, he served as senior vice president, divisional merchandise manager of women’s apparel for Kohl’s Corporation, vice president of junior sportswear from July 2000 to October 2003 and vice president of planning/allocation for women's apparel from December 1999 to July 2000. From June 1990 to December 1999, Mr. Boyle held various merchandise positions, including divisional merchandise manager of women’s at May Company. Mr. Boyle brings to the board extensive experience in merchandising, brand management and omni-channel leadership

Mr. Mesdag has been a director since January 2014. Mr. Mesdag is the Managing Partner of Red Mountain Capital Partners LLC, the investment adviser for Red Mountain Partners, L.P. The Los Angeles-based fund invests in small-cap public companies and adds value through its constructive engagement with management teams and boards.

Prior to founding Red Mountain in 2005, Mesdag spent 21 years with Goldman Sachs. He became a general partner of the firm in 1990 and worked in New York, London, Frankfurt, and Los Angeles in the fixed income and investment banking divisions. Prior to Goldman Sachs, he was a securities lawyer with Ballard, Spahr, Andrews & Ingersoll in Philadelphia. He received his B.A. from Northwestern University in 1974 and his J.D. from the Cornell Law School in 1978.

Mesdag serves on the board of Heidrick & Struggles International, Inc., a publicly-traded company. He previously served on the boards of Encore Capital Group, Inc., 3i Group plc, Nature's Sunshine Products, Yuma Energy, Inc., Cost Plus, Inc. and Skandia Group AB.

Having had an extensive career in international investment banking and finance, Mr. Mesdag brings to the Board significant knowledge and experience related to business and financial issues and corporate governance.

Ms. Ross has been a director of the Company since January 2013. In May 2014, Ms. Ross joined Google X as head of Glass and is currently Vice President of Hardware Design at Google. From July 2011 until April 2014, Ms. Ross was the Chief Marketing Officer of Art.com from where she oversaw the company's marketing, branding, merchandising and user-experience functions. Prior to Art.com, from June 2008 to June 2011, Ms. Ross was EVP of Marketing for the Gap brand, and also acted as the Creative Catalyst for all brands within Gap, Inc. Ms. Ross also has held senior creative and product design positions at Disney Stores North America, Mattel, Calvin Klein, Coach, Liz Claiborne, Swatch Watch and Avon. Chosen by Fast Company and BusinessWeek as the new face of leadership, Ross was a contributing author to "The Change Champions Field Guide" and "Best Practices in Leadership Development and Organizational Change." She has also served on Proctor and Gamble's design board since its inception.